The line separating investment and speculation, which is never bright and clear, becomes blurred still further when most market participants have recently enjoyed triumphs. Nothing sedates rationality like large doses of effortless money. After a heady experience of that kind, normally sensible people drift into behavior akin to that of Cinderella at the ball. They know that overstaying the festivities—that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future—will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There’s a problem, though: They are dancing in a room in which the clocks have no hands. (2000 Chairman’s Letter)

You want to be greedy when others are fearful. You want to be fearful when others are greedy. It’s that simple. (October 1 2008 on Charlie Rose (PBS))

Rule No. 1: Don’t lose money Rule No. 2: Don’t forget Rule No. 1

⁃ Warren Buffett

The Market and Economy Today

Guys, this has been one helluva party. The inflation crisis-averted, Wall Street is looking at a Goldilocks scenario that will last…forever. It doesn’t matter that 7 stocks now comprise nearly 30% of the S&P 5001, or that the average inflation-adjusted price-earnings ratio is now back over 332, or that Americans now own over $1 trillion of credit card debt outstanding at much higher interest rates3. Nope, none of that matters. The Dow Jones and S&P made all-time new highs and continues to rip higher. Let the good times roll!

Jokes aside, this is definitely a time to be cautious as we are doing. Remember there are good times to buy stocks and there are bad times, it all depends on the price. So let’s take a look shall we.

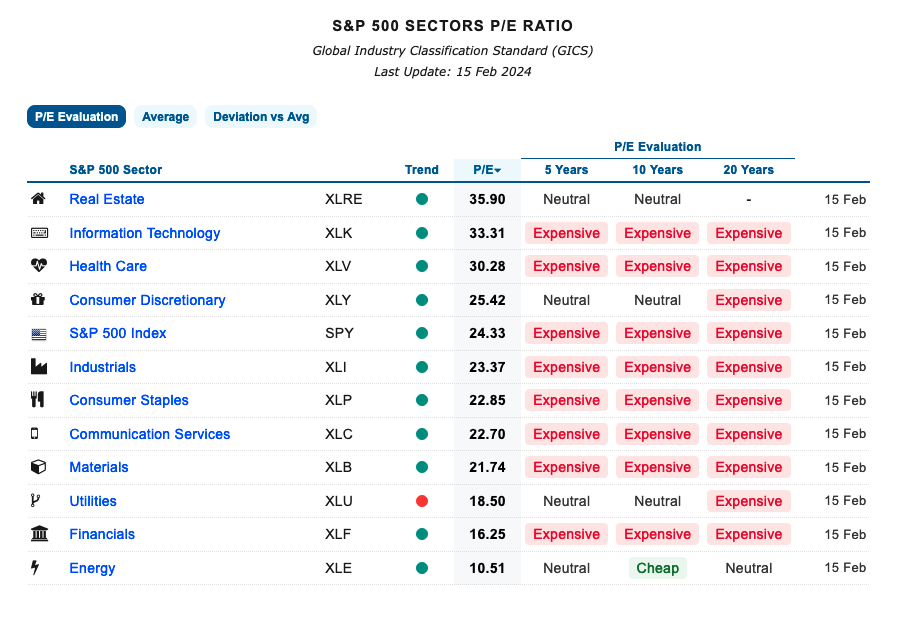

(Red means expensive; green means cheap. Click image above for larger interactive map)

Source: https://finviz.com/map.ashx?t=sec_all&st=pe

Wow, look at all those bargains! Being a business owner myself, I ask myself every now and then how much my own company is worth if I ever decide to sell it to someone. I think about how much I’d sell for and how much someone would be willing to pay. These are very natural questions to ask. So I ask myself of the S&P 500 – would I pay 33 times inflation-adjusted earnings? Is that a good price? In my estimation, of course it isn’t.

But that doesn’t seem to matter to the market these days. What was already expensive is becoming more expensive. There are only two sectors that are cheap to us – oil/gas and financials. The former we don’t invest in due to our ethical stance and the latter we don’t want to touch because of the risk of the regional banking crisis starting up again. Nearly everything else is trading in multiples that are in La La Land (or is it Barbieland). By the way, it’s not just tech. Take a look at each S&P 500 sector…

(Click image above for larger size)

Source: https://worldperatio.com/sp-500-sectors/

This time might be different, but there never has been a major bull market in history that started from high valuation multiples, low unemployment, and high profit margins. Today we have the exact opposite of those conditions in place, and it’s also typically where major bear markets form.

Recession Call Update

“Wait a minute VJ – what about the recession? You know that recession that you’ve been calling since last year?” In a video released last August, I discussed how the market is looking like a mania and although it is really difficult to know when they will end, they usually end in a recession. Well, I’ll admit to you that it has been very surprising and humbling to me as well that we haven’t had a recession yet, and I have to at least admit the possibility that I might be wrong. If I am wrong, we’ll find out by the middle of this year, i.e. if we don’t have a recession starting by the middle of 2024, then VJ was wrong about the recession call.

If we do get that soft landing, or even a no-landing later this year (i.e. slower economic growth while avoiding a recession) – it will shock market historians and I will personally send Fed Chair Jay Powell a premium bottle of wine and a box of caviar to congratulate him. (Now that I think about it, I don’t think the Federal Reserve accepts gifts, so maybe scrap that idea.) As we have talked about in a previous market update, if we dodge a bullet this time, it would be the first time IN HISTORY that an inverted yield curve, a declining leading economic indicators index, and declining money supply did not produce a recession. And it’s true that we’ve lost out on the upside somewhat, but, in my estimation, thankfully by not that much because we continued to get a relatively decent yield in short-term Treasuries.

It’s in my nature to always think of what can go wrong before what can go right, to think of risk before return; so caution is still in the order of the day, but it is possible that this might be that final leg of the previous bull market (or heaven forbid, the first leg of a new bull market) and we could go higher. I want us to participate while being mindful of not taking on too much risk. So we are going to start wading into the highest quality stocks out there, typically those with lots of free cash flow and are considered large-cap value, while keeping a eye on staying nimble and tactical if and when things change.

Sources

1 https://www.slickcharts.com/sp500

2 https://www.multpl.com/shiller-pe

3 https://www.cnbc.com/2024/02/12/in-credit-card-debt-here-are-some-expert-tips-to-help-pay-it-off.html

Copyright © 2024 ConCap® LLC. All rights reserved.

Investment advisory services offered through ConCap® LLC, a registered investment advisor.

The opinions expressed in this commentary are those of the author. Any contents provided are meant for informational purposes only, does not constitute tax or investment advice, and should not be regarded as a recommendation, an offer to sell, or a solicitation of an offer to buy any security or interest in any fund or issuer of securities. They are also not research reports and are not intended to serve as the basis for any investment decision. Comments concerning the past performance of [e.g. monetary instruments, investment indexes or international markets] are not intended to be forward looking and should not be viewed as an indication of future results. All investments involve risk, and the past performance of a security or financial product does not guarantee future results or returns.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding market or other financial information, is obtained from sources which we, and our suppliers, believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The S&P 500 index is a capitalization weighted index of 500 stocks representing all major industries with dividends reinvested. This index is utilized for comparison purposes as indicative of the broad market. Treasuries are issued through the U.S. Department of the Treasury and are backed by the full faith and credit of the U.S. government.